Daryl Fairweather ’10, the chief economist at Redfin, a leading digital real estate brokerage, uses her economics training to help clarify the big questions about housing markets. In a new book, she shares how the lessons she uses every day can help readers make better decisions about education, jobs, and family.

As chief economist for Redfin, Daryl Fairweather often encourages prospective home buyers, renters, and sellers to take a step back, reevaluate, and act in their best interests. It’s an approach Fairweather has often used in her own life, including when deciding what path to take at MIT.

"I came to MIT to study engineering, science, and math, but I quickly fell in love with the MIT way of thinking about the economy: mathematical logic applied to how humans interact and accomplish things together," says Fairweather. "That way of thinking has served me well in both my economics research and navigating my career while understanding my place in the economy."

From MIT to market insights

Fairweather's background in behavioral economics, combined with Redfin's data and on-the-ground input from agents, gives her a unique ability to explain housing and economic trends to the public. She pops up frequently in the media and on social media to cover everything from buyer and renter sentiment and the housing-market impacts of climate emergencies to what betting markets can tell us about economic forecasts. Fairweather has also been an outspoken advocate for land-value taxes—an oft-overlooked concept that she believes would reduce blight and raise funding for urban economies, all while encouraging much-needed housing development.

So, how did this budding engineer become one of the most sought-after voices on the housing market? After converting to an economics major, Fairweather analyzed mortgage data as part of an Undergraduate Research Opportunities Program (UROP) project on how households make financial decisions regarding their mortgages. This work, along with a part-time research position at the Federal Reserve Bank of Boston, where she analyzed households facing foreclosure during the financial crisis, sparked Fairweather's interest in the housing market.

Fairweather went on to complete her PhD in economics at the University of Chicago, where she was advised by Richard Thaler, a founder of behavioral economics, and researched behavioral-adjacent topics, including how our peers impact the decisions we make. This doctoral work helped land Fairweather a senior economist role at Amazon, where she spent two years managing a team of analysts working on problems related to employee engagement before moving to Redfin.

Of all the projects Fairweather has spearheaded at Redfin, one of her favorites is a field experiment studying if and how the risks of climate change affect homebuyers' decisions. During a three-month period in 2020-2021, Redfin ran a randomized controlled trial involving 17.5 million Redfin.com users, in which half had access to property-level flood-risk scores, and half did not. Homebuyers in the treatment group who viewed homes with severe or extreme flood risk proceeded to bid on homes with 54% lower risk after gaining access to the data—even during a period when record-low mortgage rates and an intensifying housing shortage were fueling intense competition for buyers.

The study, which is also an NBER working paper, provides "definitive evidence that the risks posed by climate change are affecting where Americans choose to live," as Fairweather summed it up in a 2022 Redfin News article. "Before Redfin's experiment, that was just a hypothesis. Equipping people with flood-risk information helps them make more informed decisions."

Lessons for work and life

Fairweather's interest in behavioral economics also dovetailed neatly with her work at Redfin, given that psychological stumbling blocks can be rife during home buying and selling. "It's a very emotional thing to buy a home," Fairweather said in a 2023 interview for the St. Louis Fed's Women in Economics podcast. "I try to incorporate what I've learned about behavioral economics and biases so that home buyers and sellers can make rational economic decisions when buying a home and not let the psychological factors steer them in the wrong direction."

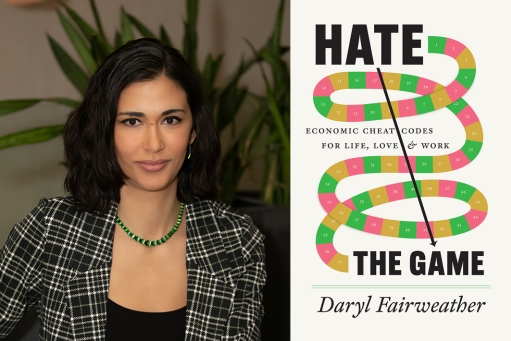

Fairweather's new book Hate the Game shares her advice for making the big housing decisions—whether to buy or rent, where to live, how to pay for it—and teaches readers how to harness the same lessons from game theory and behavioral economics to make smart choices as they navigate education, family, and the job market. Fairweather learned many of the “economic cheat codes” in Hate the Game through hard-won experience in academic and industry, making the book a sharp, valuable resource for anyone looking to take control of their life and career.